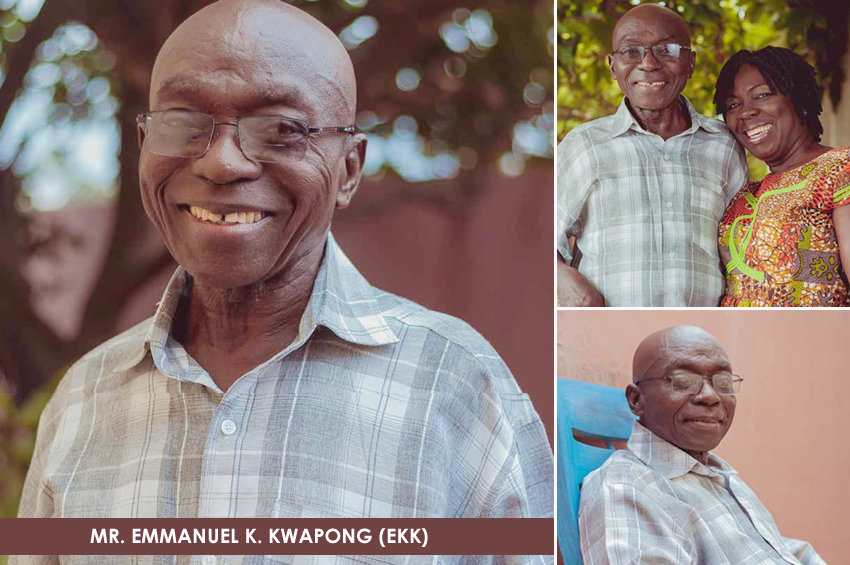

An Interview with Mr. Emmanuel K. Kwapong (EKK), First Managing Director of ARB Apex Bank

Mr. Kwapong, the first Managing Director of ARB Apex Bank led the Bank from 1999 to 2007. In this edition, we tell the compelling story of Mr. Kwapong and the immense legacy he left.

TRB: Good morning Mr. Kwapong. Thank you for welcoming us to your home. We see it as a rare privilege to be interviewing you today as the first Managing Director of the ARB Apex Bank.

EKK: Thank you and it’s my pleasure to welcome you.

TRB: Can you please take us through some of the hurdles you had to cross to get the ARB Apex Bank running?

EKK: Alright. The major hurdle I would start with was funding. In the year 2000, we needed funding because apparently by the time we were ready to start operations, the Rural and Community Banks (RCBs) who were supposed to be the shareholders of the ARB Apex Bank had not contributed any money at all. So, we started off with Bank of Ghana (BoG) registering as the first shareholder of the Bank and then, we proceeded with seminars to educate the RCBs about the need to put in money for the new company we wanted to establish. At a point, we agreed that the RCBs should deposit five (5) percent of their total deposits with the ARB Apex Bank as a mandatory primary reserve. This was approved by the BoG. Again, we had problems with the RCBs freely or willingly bringing in those funds.

Then we came to external funding, TTELLING OUR STORIESwhich was to come from the Rural Financial Services Project (RFSP). Here again, the project was negotiated with the World Bank as partners, I think in June 2000, and we were expecting that by the middle of the year, things could take off. It didn’t happen that way. We had to wait till the end of the year 2000, because the Minister was not ready to sponsor or approve the funding. Why, because we had registered the name of the Bank as the ARB Apex Bank. And his take was that the government wanted it to be GHAMFIN, which was the Apex of all Micro-finance Institutions (MFIs) in Ghana. So he (the Minister) wanted it to be known as GHAMFIN Rural Bank. This brought a lot of controversy between the Association of Rural Banks (ARB) and the Ministry. Finally, I think the change of government happened at the end of 2000 and in 2001 we had to wait until March before a new Minister was appointed by the new government and we contacted the Minister. From there, we started activities towards getting the Cabinet to approve it as well as Parliament to approve the project. Finally, it was in November 2001 that the project was approved by all parties. We started receiving funds in 2002. These were the initial funding problems we faced.

When it comes to the operations side, we also experienced a lot of difficulties with the RCBs responding to letters we sent out to them requesting information because there was no data at all. So we needed to build data from scratch. When you send out circulars, some of the RCBs would never mind. It had to take a lot of effort to get them to respond to requests from the ARB Apex Bank. One area which I remember very well was the area of account numbering. At first, all the RCBs were using alpha-numeric formats (a combination of numbers and alphabets) in generating their account numbers. But the computers would not accept these, so we asked that they should change the numbering and also bring in codes so that their various agencies would be recognized in the account numbering system. It was really a very tough undertaking. We had to hold two seminars, after sending out the circulars, informing them about the step by step approach. Again, we had to hold a workshop to train them on what I would rather say “a simple thing”. These are some of the initial hurdles.

TRB: Who were the pioneering staff of the Bank and how easy was it to carry your colleagues along with you?

EKK: Oh yes. First, when I came in, we had the Administrative Secretary, Mrs. Francisca Attipoe and then we had an Accounts Officer, Mr. Solomon Boateng, who has now left for SG Bank.

There was also a Transport Officer, Kobina Takor Aidoo. Then we brought in Mr. Kenneth Owusu-Twumasi to take care of the Human Resource side and then later, Mr. Felix Kodzo Akatti who is no more, may his soul rest in peace, to also set up the Banking Division. We also had assistance from the Association of Rural Banks (ARB). We had the late Mr. Richard Mettle-Addo, Mr. Robert Kudjoe, and Mrs. Eunice Osei-Bonsu who later joined us from the Association as a full time staff. All of them were at the Association at the time and they came in later to support the few resources that we had at the Apex Technical Secretariat and they did a very good job, assisting us to set up the Bank. We also had Ms. Margaret Afari-Assan, also working at the Association but later joined us as a full time member of staff. So these initial staff members were very very hard working. We had a good time, because they didn’t mind what the clock said at the time. We only worked up to the time they finished their tasks.

At the time the Bank started, most of those who joined were either former Ghana Cooperative Bank staff or Bank for Housing and Construction staff. These two banks collapsed in early 2000, we had the redundant labour around and we brought them in. I came from Barclays Bank and had this background in systems and ethical behaviour and therefore how to get these other people from the other banks, how to ‘marry’ them or how to get them to also conform to what we were doing was a big challenge. However, we managed to train them in whatever procedures we wanted to install at the time and they responded positively. It was a challenging task, but we were able to do it.

TRB: How supportive were governments in the setting up of the ARB Apex Bank?

EKK: Governments, yes, you’re right governments. The first government support started around 1998 when the Transitional Apex Steering Committee, which established the Apex Technical Secretariat was set up. The government changed at the end of 2000. Both governments were so helpful. The Rural Financial Services Project was a government of Ghana Project, aimed at improving financial services delivery at the rural end in order to transform the rural economy and also to reduce poverty. So when this project was set up, we had a component that dealt with the building of the Apex Bank head office. One other component was to strengthen the rural banks as well as the micro-finance or the informal part of rural finance. I can say government support met a lot of the funding requirements, because what was allocated to the Apex Bank was able to support the establishment of the Bank and got it running. The Rural Banks who are themselves the owners of the Apex Bank, by the end of 2007 when I was leaving the Bank, only GH¢2.3 million had been contributed as equity from the rural banks. All the other funding came from the Rural Financial Services Project. Therefore, I would say governments were very supportive.

TRB: What were some of the key challenges you faced as first Managing Director?

EKK: Well, there were many challenges when we opened the Bank on 2nd July 2002. At that point, the Bank was so fragile and we needed to stabilize it. Fragile on the account of the fact that there were so many challenges and so much sabotage against the Bank. Rural banks were supposed to place 5 percent of their deposits with the Bank. They would not bring the money. They would not take up shares. Again, we had people going round the villages or the rural areas informing the population that, “oh that Apex Bank is not approved by the Bank of Ghana, so it would not stand”. The Magnetic Ink Character Recognition (MICR) that we introduced for the first time to the rural banks was rejected by, I would say, the whole public but mainly where the rural banks wanted to use it as draft to pay for their services such as water, electricity and the like, and transfer money to their wards in schools, this would not be accepted. So we had a tough time, trying to get the Bank going.

The strategy was that we had to convince the rural banks to assist us to convince the people. We also organized seminars for journalists, where we invited senior journalists to come, so they send out the message to the public explaining the functions of the Bank. We also took out full-page adverts in newspapers so that people would know about the Apex Bank. Again, at the FM stations, we had the Apex Bank managers who were joined by some of the Rural Bank managers who could speak the local dialect to go to the radio stations to explain to the people about what the Apex Bank stood for. We also had to introduce some products such as the Apex Certificate of Deposit (ACOD) so that it would be attractive to them to keep their monies here.

So all in all, much as we had challenges, unfortunately, some of them were from within, in the sense that before you could start the Apex Bank, you had staff working in the commercial banks and you need them. They are the people who were on the Boards of the RCBs and they had interests and so some of them would send information to their banks that this was happening at the rural banks. One day, we were there when one of the banks in the Central Region was invited by a commercial bank that they (the latter) would deliver cash to their doorsteps. So they shouldn’t send their money to the Apex Bank.

So that Bank was not sending us money until we got our own bullion vans to start delivering cash to them. Some of the managers too were happy taking some handouts from these commercial banks in order to frustrate efforts of the Apex Bank. So, I would say that we managed through these storms and got the rural banks to agree to finally support our business.

TRB: How about the successes?

EKK: Well, the successes I will say probably are there for all of us to see. The rural banks, coming from individual, stand-alone entities and now in a networked situation, and coming together, they are becoming stronger. I will say that by the time I was leaving, in 2007, our total assets had increased by about 625 percent, total deposits grew to 650 percent but most important was total loans and advances shot up by about 1040 percent and this really, confirmed that we had achieved, not only our goal but government’s goal of making credit available at the rural areas.

TRB: Can we say that you are a very proud person to have seen this vision through?

EKK: Oh, yes, certainly. By His grace, by the grace of God and I always pray for the rural banks, to see them grow. Where I have my farm, I went there in 2001, the manager didn’t even have a place as the manager’s office. Now, they are in a very first class storey building. And the staff look so smart, ambiance in the main banking hall is so nice and so it is in so many rural banks.

TRB: Looking back, what advice do you have for both policy makers and shareholders of the RCBs, particularly given the stiff competition in the banking environment?

EKK: I think I would be looking at three areas: Operations, Legal and regulatory framework and Capitalization.

When it comes to operations, the government brought in money under the Rural Financial Services Project (RFSP) and then the Millennium Challenge Account Project to fully computerize the rural banks. What the rural banks need right now is to meet recurrent expenditure and to provide for replacement costs of the equipment they received, which means that they would need to generate funds to be able to do so. But the most important thing about computerization is that, you know the jargon is, ‘garbage in, garbage out’. Now, we have badly organized business processes. If you put these badly organized business processes into the computer, you would end up rather paying more as a cost.

What is happening in the rural banks as I go round is that, they are still in the old ways of doing things. You can see the files around, you can see registers around, and they are still filing in these things manually. Policy makers, boards and the Apex Bank must ensure that the business processes of the rural banks are re-engineered. Re-engineered so as to cut off waste, to reduce customer waiting time and whatever would add value, you bring it. For instance, if we have printed forms in the rural banks and you can look at it on their balance sheet, stationery cost, etc. Most of these things could be printed right away when the customer comes, you don’t need to pre-print and stock them as stationery. That is money sitting there. Some of them, for ten years, they never use them.

Again, both the Apex Bank and the rural banks are interest income dependent. Most of our income comes from either interest in Treasury Bills or loans. Apex is even the worse. So now, if the government’s macro-economic management takes hold, interest rates would drop significantly. If interest rates should drop significantly, then he obvious thing would be that most of the banks would start making losses.

So what Apex should do is to introduce products, which will bring in commission and fees income to both the Apex Bank and the rural banks. And this you can do through the computer system, the electronic products so that quickly we can begin to earn more income from that stream. At least if we should cover our operations costs, then no amount of government action with respect to the economy will affect us.

The legal and regulatory framework area, you know the Apex Bank Regulation L.I. 1825 was passed in 2006. It is a high level Legislation, which regulates the rural banking industry. However, the fine details, the bolts and nuts of it, to give effect o some of the regulations would have to come from the by-Laws, which the Apex Bank has put in place. Before I left in 2007, we had made a draft of the by-laws, which would give Apex firm authority to deal with situations we were grappling with, such as, rural banks would not mind if you send them notices that do this or do that. So to enforce compliance, we have to get these by-laws working. I have not heard that it has been implemented and I would hope that the Apex Board would have to work closely with the Bank of Ghana to work on the by-laws and regulations, which ensure that a new L.I. is passed.

The other issue has to do with the capital of the Apex Bank. The Apex Bank is under-capitalised, so also it is with some of the rural banks. We need o raise fresh capital, but the present policy under the L.I. 1825 is that the rural banks should be the sole owners of Apex Bank. So if they are the sole owners, then if you need capital, the owners of the Bank should come up with the capital. We realized that none of the rural banks could pay more than 20 million old cedis (now GH¢2,000) and when we examined the situation closely, some of them could not even pay the deposit. Some of them were asked to pay just a token of 1 million old cedis which is GH¢100, and that has been the problem all along. So now if we say the rural banks should come up with capital and stay within the policy of they being the sole owners of Apex Bank, then it’s going to be a problem. Because I don’t see them coming up with capital for the Bank to stand on its feet.

But if we now want to bring in new investors, then we need to change the law so that new investors will come in. The investor coming in also will be required to do a number of things, which would require that you change the face of the Bank and all that. We should be careful to have investors who would share in the vision, mission and the objective of setting up the Bank. I can see that those investors might come and the structure of the Bank would change. You may have a rural banking division and a commercial banking division. The commercial banking division would pursue all relevant activities just as the universal banks do and that would be good for the Apex Bank, to bring in and widen the scope of such activities. There has been talk about when that happens, then Apex Bank would be competing with the rural banks. I don’t believe in that. What the new investors should do is to segment the target market. It should not go to the low end of the mass market, where the rural banks operate. It should deal with the middle and the upper market. Companies and high net worth individuals and where Apex would come in to join the rural banks would be after the fast growing medium size enterprises. Let’s say an enterprise needs some money, where the rural banks cannot support, Apex would then add money. I know of the One-District-One-Factory (1D-1F). A rural bank is seriously involved. That rural bank is just looking at funding the out grower farmers. But the juiciest part of that company’s business would go to another commercial bank, because the Apex Bank cannot handle its external trade financing.

This is where the problem would be, that the investor must come up with capital, which would enable Apex to acquire the Universal Banking License so that it can do a whole range of products. Acceptances, guarantees, letters of credit etc. All these would bring in additional income. So these are my few thoughts for policy makers to consider.

TRB: What is your take on the new minimum capital requirement for the RCBs?

EKK: Well, GH¢1,000,000 is not an easy money. Some of them have already met this new capital requirement. But some of them would not be able to meet it. As is happening with the universal banks, the Governor of the Bank of Ghana is advising that those which cannot come up with the new capital requirement for the universal banks should merge. So also would be the advice I would give to the rural banks. I hear some mergers are starting, this should continue, in my opinion until the next say, 10 to 20 years’ time when each region would have one big rural bank, which would take care of their needs and it would be a strong one. If they still continue in their parochial interest of wishing to have a traditional bank, it would not work. So they should not just think about GH¢1 million, they should think about GH¢20, GH¢30 million, merge their operations so that in due course, we can see one big rural bank for each region. That can open branches everywhere in the region. That would have the asset base to support every operation in the region. They should be thinking of pooling their resources. It would be a nice thing. Denmark, we were there on a visit, we saw that their cooperative banks merged their balance sheets and became very strong banks.

TRB: Please what have you been up to since you went on retirement?

EKK: I am back to my number one profession, which is farming. As soon as I came out, I acquired land in the Afram Plains – I am doing maize, plantain and mangoes and I’m into bee and beeswax production.

TRB: Can you please give us a peep into your memoirs?

EKK: Oh, not quite. Indeed, I have started writing about the Apex and the rural banking sector. About my memoirs, that one, I shall let you know when I start one.

TRB: Thank you for welcoming us to the serenity of your home.

EKK: My pleasure and thank you too for coming through

|

|